DHL express shipments fell sharply when the U.S. government recently eliminated a waiver on duties and fees for small-dollar shipments arriving from China and Hong Kong. Applying the new rule worldwide at the end of August could reduce projected full-year operating profit by $231 million, the company’s chief financial officer said Tuesday.

DHL Group increased profits during the second quarter, despite a rise in protectionism and fighting in the Middle East that lowered shipment volume, by successfully eliminating structural costs and improving yield management.

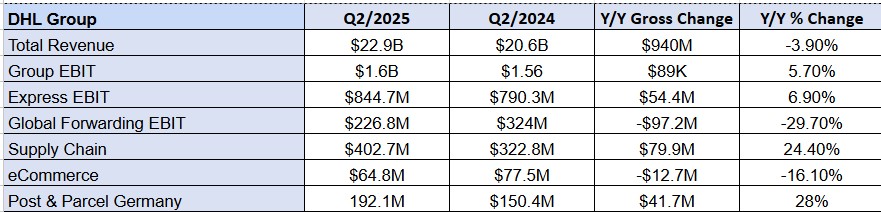

The integrated parcel logistics giant reported second quarter revenue decreased 3.9% to $22.9 billion, but operating profit grew 5.7% to $1.6 billion with profit margins improving 0.7 of a point to 7.2%. Slower trade activity and negative effects of exchange rates diminished results.

“We anticipate continued volatility in the global economy in the second half of the year. Our focus on efficiency improvements and growth markets is paying off in this situation. We have adjusted our capacities to the volume development and achieved structural cost improvements,” Chief Financial Officer Melanie Kreis said in the announcement. “This combination has significantly contributed to earnings growth. We are working to further improve our efficiency and leverage growth opportunities in the current environment.”

Express overnight B2C shipments fell 20% in large measure due to the U.S. imposition of tariffs on low-value parcels from China and Hong Kong that previously enjoyed duty-free access. Meanwhile, B2C volumes in Europe for DHL eCommerce were strong, up 11%.

Rival UPS last week also described how the elimination of the de minimis policy caused average daily volumes on the China-U.S. trade lane to tumble 35% during May and June. That is UPS’s most profitable trade lane, but DHL has less exposure to it.

Only 8% of DHL Express overnight shipments move from China and Hong to the U.S., while only 4% of DHL Global Forwarding’s airfreight volume is on that route. The carrier last year began to squeeze out low-margin, lighter-weight e-commerce traffic by raising prices and selling the space to freight forwarders with more dense cargo, management said during an earnings presentation on May 2.

The Trump administration last week declared that the crackdown on de minimis shipments will extend to the rest of the world on Aug. 29. Chief Financial Officer Melanie Kreis said the new rule could wipe out as much as $231 million — or 3.3% — from full-year operating profit, but she said that was a worst-case scenario that wasn’t likely to happen.

“It’s not the likely scenario. That is why we have not included it in the guidance,” she told analysts.

DHL maintained guidance for operating profit of at least $6.9 billion and free cash flow of about $3.5 billion in what it anticipates as a subdued macroeconomic environment.

Management said the Fit for Growth plan, launched this year with the goal of eliminating $1.1 billion in structural costs by the end of 2026, along with regular capacity adjustments enabled DHL to control expenses.

DHL Express, for example, experienced an overall volume decline of 10% in its core time-definite international air product (only down 2% in the B2B segment), but was able to increase operating profit and margin through effective capacity management and other savings. Taking out capacity, primarily from China to the U.S., lowered airfreight network costs by 8%. Express also cut pickup and delivery costs by 5% mostly by reducing U.S. capacity to adjust for the lower inbound package volume from China and consolidating deliveries. The division was also able to reduce full-time employees by 3.2%, while maintaining price discipline.

Earlier this year, DHL began streamlining the number of partner airlines that supplement transportation provided by DHL’s own fleet. Kreiss said DHL is able to easily flex capacity because it has a mix of long-term, medium-term and short-term leases with a variety of third-party carriers and can move aircraft from less busy to busier routes, as needed.

“When volumes come back, that will allow us also to flex back up,” she said.

All divisions recorded lower revenues, led by a 5.7% decline at Express. Revenues for Germany’s postal operator ticked down 0.2%.

Global Forwarding and Freight produced the worst year-over-year results, with a nearly 30% drop in earnings before interest and taxes on a 5.3% revenue decline. The division recorded a slight increase in airfreight volume, while ocean freight volumes declined 6%year over year. Ocean volumes were flat if two companies that are no longer customers are excluded. Performance was signficantly affected by the economic slowdown and weakness in the German and European trucking sector.

Kreis said on the analysts’ call that it is too early to determine how the new U.S.-EU trade deal would impact import-export activity because details are still to be finalized, but a 15% U.S. tariff could impact trans-atlantic volumes.

UPS last week also said U.S. tariff policies and economic weakness dragged down volumes and revenue, but unlike DHL its cost-reduction campaign was unable to prevent a drop in operating profit. About 14% of DHL’s international trade volume goes to the United States.

Other DHL divisions also had mixed results during the second quarter.

DHL Supply Chain increased operating profit and margin with the increased deployment of digitization and automation. The top line would have been flat, instead of down 3.9% if not for currency exchange headwinds. The sluggish global economy is reflected in lower throughput volumes in company warehouses, which is a drag on revenue, said Kreis.

Meanwhile, DHL eCommerce experienced slower volume growth due to economic conditions in some markets. Operating profit declined as the company continued to invest in network expansion, the company said.

Deutsche Post

DHL credited yield management and cost improvements with stabilizing earnings at Post & Parcel Germany, despite slower growth in parcels amid weak economic conditions, a continued decline in mail volumes and higher costs from new labor agreements. Letter mail volume declined 9% year over year. DHL says the German postal division needs to earn at least $1.2 billion per year so it can fund investments for the transition from letter to parcel business and in clean-energy vehicles.

By the end of the year, Post & Parcel Germany will have 4,900 electric vans from Ford Motor Co. in its delivery fleet after taking delivery of 2,400 E-Transit two-ton and E-Transit Custom one-ton vans, the company said last month. The total number of electric vehicles deployed in P&P will rise to about 35,000, making it the largest electric delivery fleet in Germany. DHL uses the E-Transit, which has an electric battery range of 196 miles, for urban parcel delivery. The smaller version, with a range of 203 miles, is used for letter and parcel delivery in more rural and suburban areas.

DHL is still extensively investing in products and infrastructure, especially in growth markets, but dialed back capital expenditures by 4% to $703.5 million in the second quarter in response to the uncertain economic climate.

Q2 milestones

During the quarter, the company announced planned investments of more than $570 million in the Gulf Arab states, which are benefitting from shifting trade flows, through 2030. In July, DHL Supply Chain took majority control over Saudi Arabian joint venture ASMO Advanced Logistics Services. It also expanded capabilities in pharmaceutical logistics by completing the acquisition of Nashville, Tennessee-based speciality courier CrypPDP and expanding its life sciences and health care campus near Frankfurt, Germany. The quarter was also marked by the acquisition of IDS Fulfillment, which expands Supply Chain’s e-commerce warehouse network in the United States.

DHL Express was forced to shut down service in Canada for nearly three weeks in June when the company and employees reached a standoff over a new labor contract.

In late June, DHL Global Forwarding celebrated the official opening of a new air freight hub at Frankfurt Airport, which consolidates existing facilities in one location and reduces truck movements. The 264,000-square foot cargo warehouse features 54 cross-docks and enables the processing of up to 300,000 tons of air freight for both German and international customers.

The new facility also accommodates the European headquarters of in-house air freight operator StarBroker, which is responsible for booking and coordinating air freight capacities for DHL Global Forwarding and managing controlled flight operations. The new hub facilitates services such as consolidation and deconsolidation of air freight, customs clearance, handling for truck transfers, and organization of charter capacities.

Last month, DHL announced several management changes in its forwarding, supply chain and eCommerce divisions. In an online Q&A on DHL’s website, Kreis praised outgoing CEO of DHL Global Forwarding, Tim Scharwath, for making the division more profitable, customer-oriented and efficient. Oscar de Bok, who will replace him, propelled DHL Supply Chain in 2024 to more than $1.2 billion in operating profit for the first time.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

Write to Eric Kulisch at [email protected].

RELATED STORIES:

DHL rotates leaders at forwarding, supply chain divisions

DHL Express Canada reinstates service after workers ratify labor deal

DHL Express prepares to open $140M cargo facility at Lyon airport

DHL steps up Middle East expansion with $570M in planned investments

The post New US de minimis policy could trim DHL profit by 3% appeared first on FreightWaves.