US intermodal volume outperformed truckload in Q1

(Chart: SONAR)

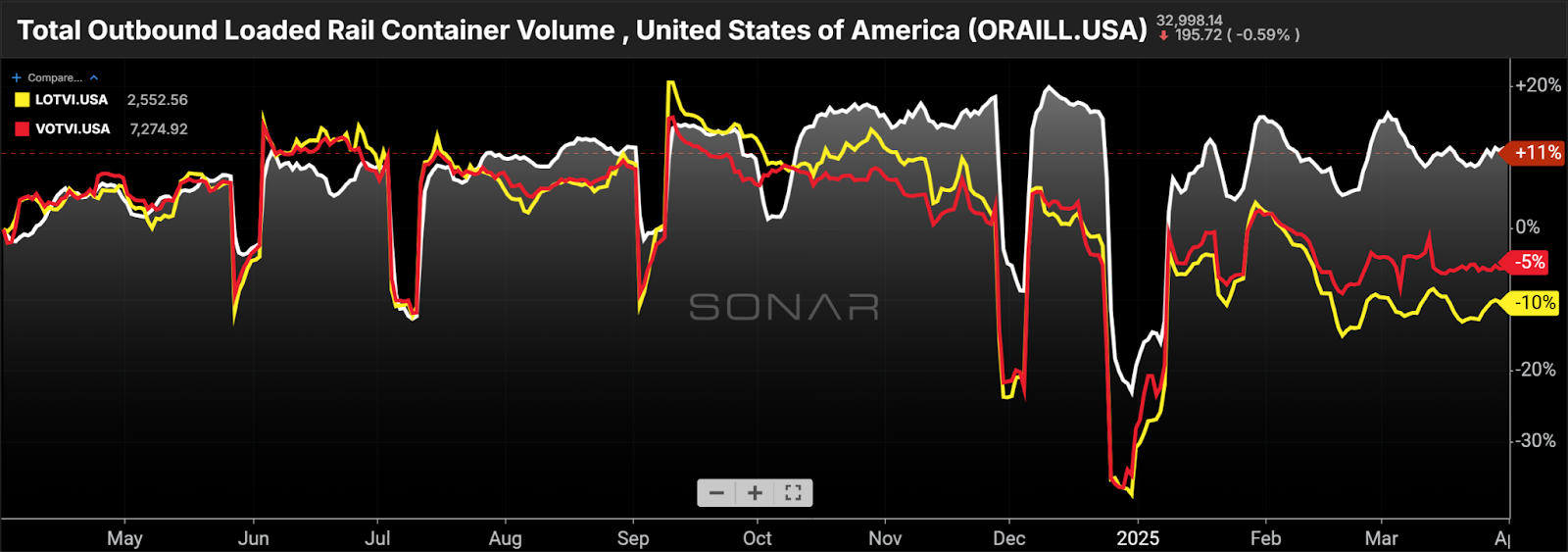

Loaded containerized intermodal volume (white line) had been trending in line with dry van truckload volume (red) and long-haul truckload volume (yellow), two segments that may be competitive with intermodal, until last year’s fourth quarter. Following the election, nationwide intermodal and truckload volume started departing significantly, likely a result of a pull-forward of imported goods to avoid tariffs. Inland movements of imported goods are more compatible with intermodal networks than many other freight lanes because of the existing density in many import-heavy lanes, such as LA to Chicago.

In addition, pulling imports forward lowers the degree of time sensitivity of many shipments, which benefits rail intermodal – shippers can even benefit from having inventory in transit when goods are moved in advance. In short, the slower shipping options are seeing more volume, which has been apparent both when comparing truckload to intermodal and when comparing expedited parcel service to value parcel service, a trend that both FedEx and UPS have highlighted.

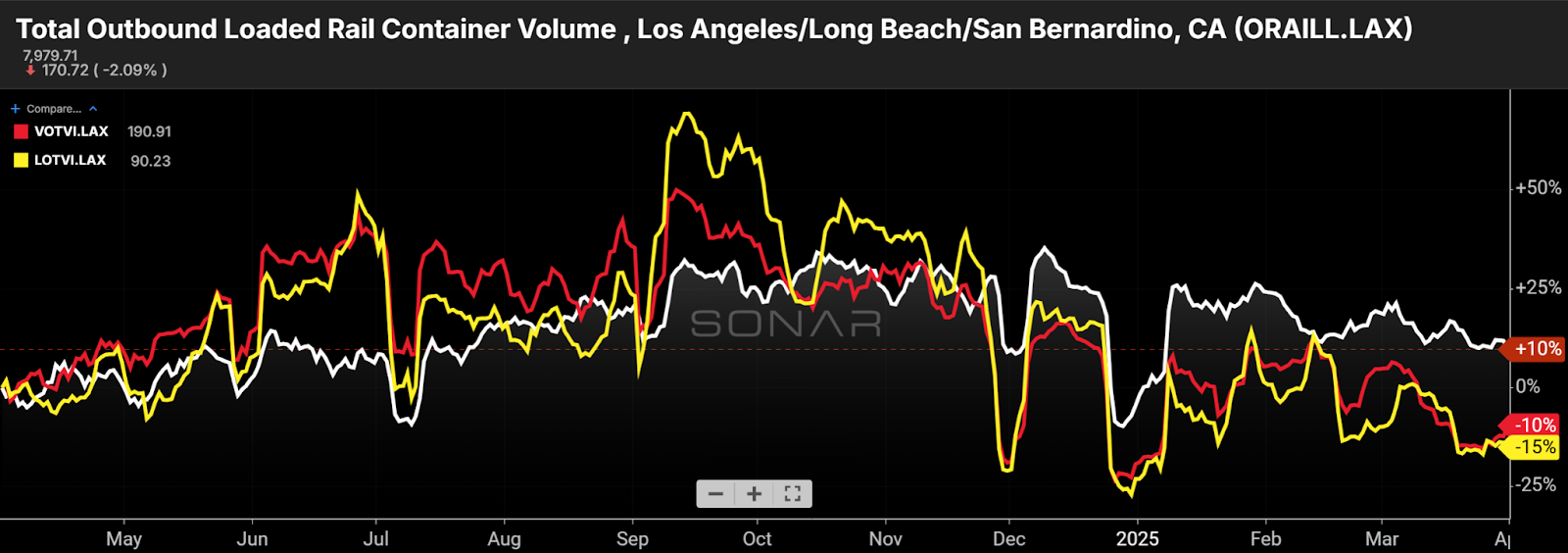

The spread between containerized intermodal volume (white line) and truckload tenders (represented by the red and yellow lines for dry van and long-haul, respectively) is even wider than the national average, relative to this time last year, when looking at outbound LA volume only. (Chart: SONAR)

International intermodal grew faster than domestic intermodal in Q1

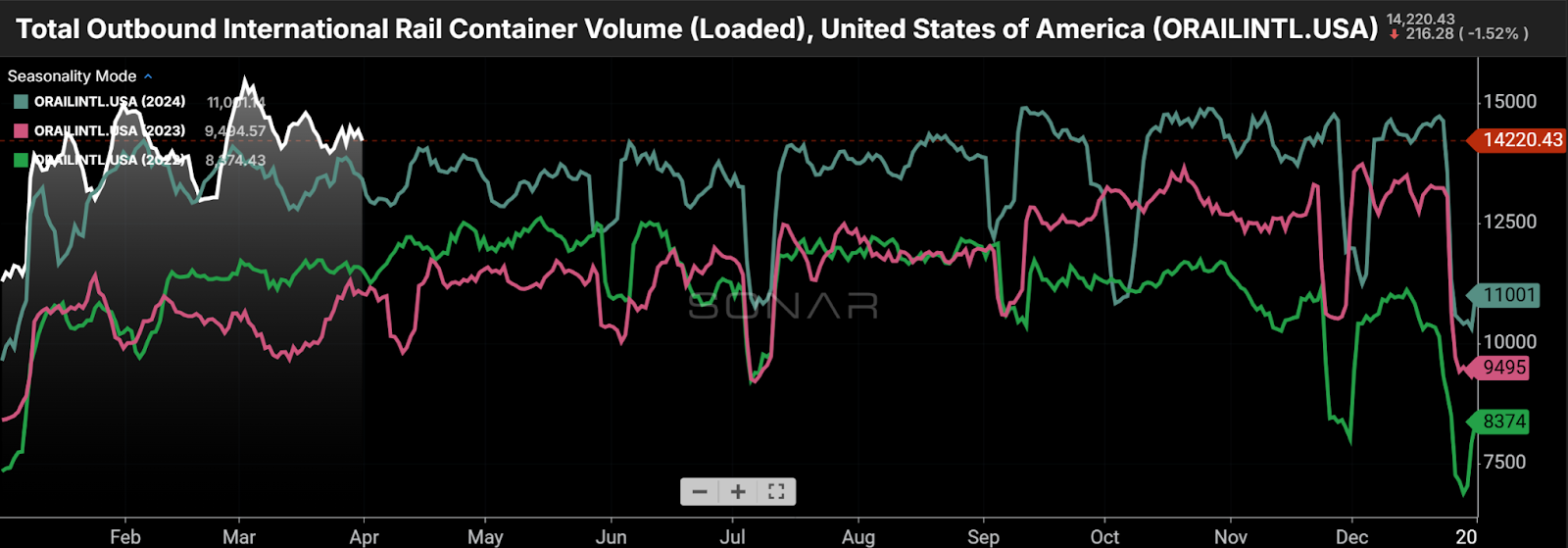

International intermodal volume grew 5.2% year over year in Q1 against a tough year-ago comparison. (Chart: SONAR)

International intermodal volume growth decelerated late in the first quarter, but the mix between international and domestic intermodal volume growth is still meaningful to carriers. In the first quarter, SONAR shows that loaded domestic containerized intermodal volume increased 4.7% year over year while loaded international intermodal volume posted a slightly higher 5.2% year-over-year increase. However, the spread was more dramatic when considering only outbound LA moves, a region that is heavily tied to imports.

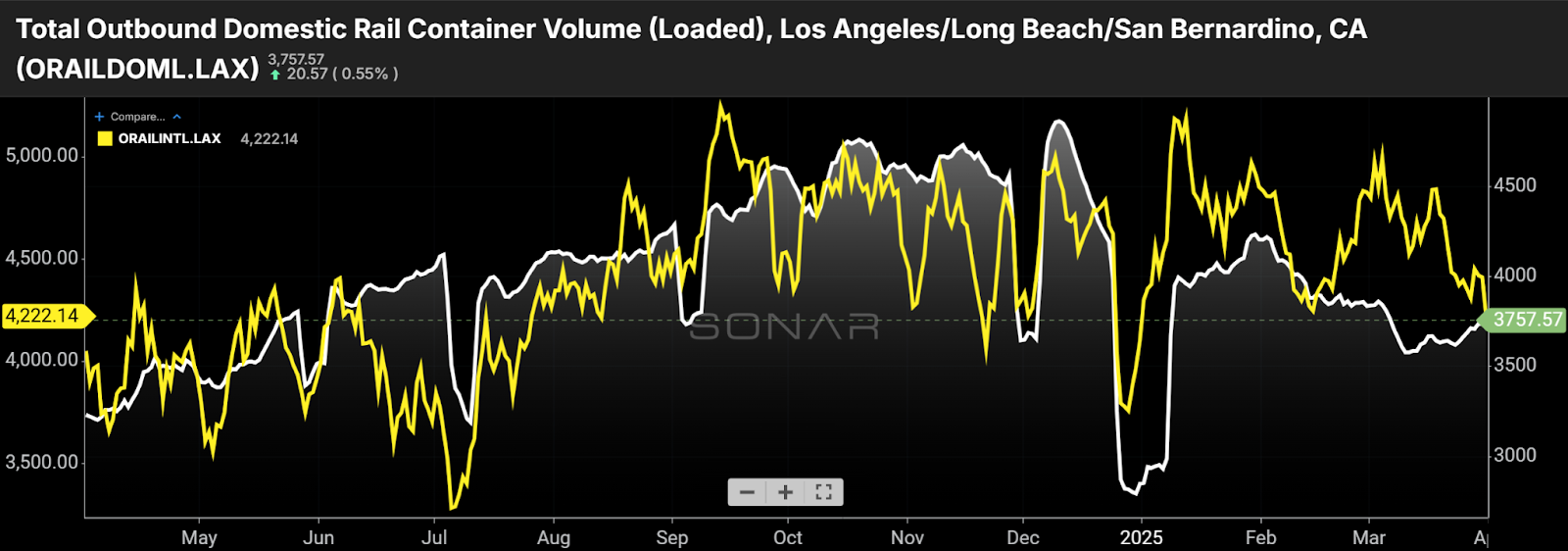

Outbound from LA, international intermodal volume grew faster than domestic intermodal volume, suggesting there was less transloading. (Chart: SONAR)

Outbound from LA, loaded domestic intermodal volume increased 10.8% year over year in the first quarter while loaded international intermodal volume increased 21% year over year. The implications are that a smaller portion of imports were transloaded from international containers into domestic containers relative to last year. That could again translate to a margin headwind for Western Class I railroad Union Pacific in its intermodal segment, as it has the past two quarters. Domestic intermodal carriers (e.g., J.B. Hunt and Hub Group) would have preferred to see more transloading of imports on the U.S. West Coast in the first quarter. But, the intermodal volume data indicates that transcontinental volume grew faster than shorter-haul volume in the first quarter, which may boost those carriers’ average revenue per load. That can create positive variance versus Wall Street’s expectations.

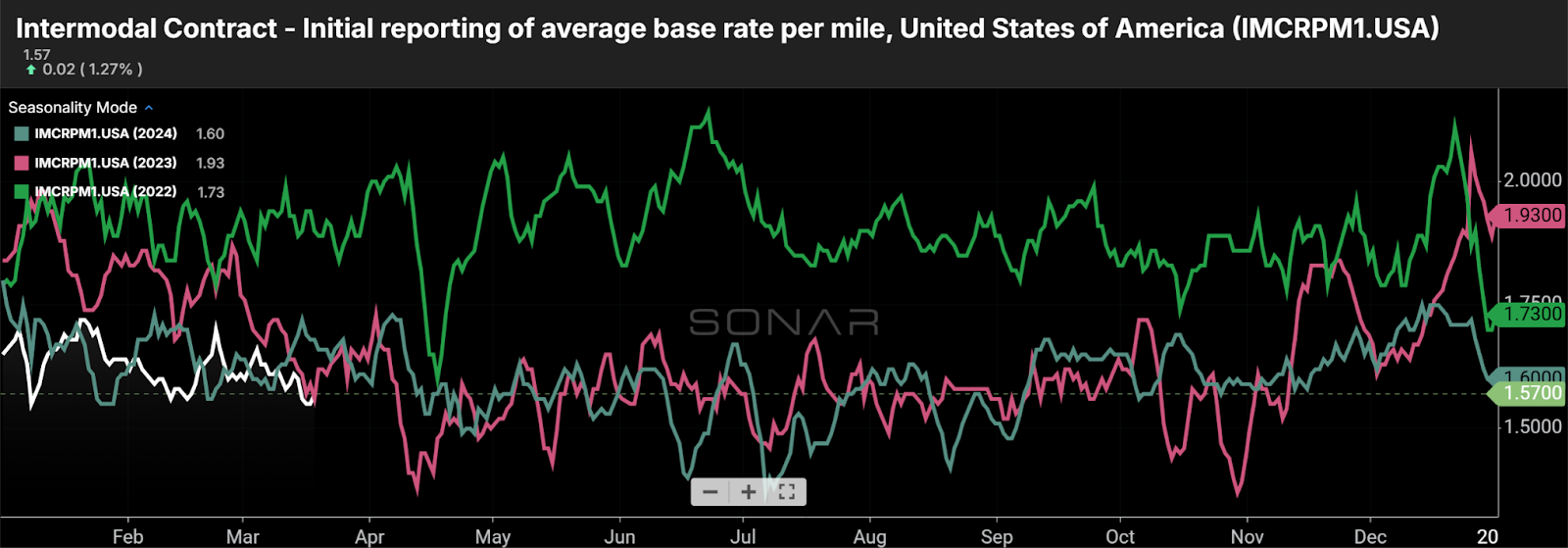

Not much intermodal pricing traction

Overall domestic intermodal contract rates were little changed year over year. The data above excludes fuel surcharges. (Chart: SONAR)

Domestic intermodal contract rates in SONAR have not moved much in the first quarter, apparently held back by excess capacity (a proxy of which is available 53-foot containers) and competition from truckload. A large portion of the contracts between shippers and domestic intermodal carriers are renewed in the first quarter. That makes the IMCRPM1.USA dataset (chart above), which is an aggregation of intermodal contract rates excluding fuel surcharges, one to watch. It’s worth noting that there is choppiness in that dataset week to week due to mix. Year to date, the data shows average intermodal rates 1.5% below last year. That’s a fairly insignificant change that could be driven just by the mix of transactions processed in the database, and also shows a lack of rate increases in the quarter.

Contract rates in dense outbound LA lanes (represented by the Transcon Index in white) have held up better than rates in shorter-haul lanes in the eastern U.S. (represented by the Local East Index in yellow). (Chart: SONAR)

Meanwhile, SONAR is showing significant differences between changes in rates for transcontinental headhaul lanes, where intermodal has a competitive advantage over truckload, and lanes in the eastern U.S., where intermodal faces more direct competition from highway carriers. The Transcon Headhaul Index, which is an average of the five densest outbound LA lanes and includes fuel, was flat year over year, on average, in the first quarter. Meanwhile, the Local East Index, which is an average of nine dense lanes and includes fuel, was down an average of 6% year over year in the first quarter. Looking at just the most recent data points in March (IMCRPM.TRANSCON and IMCRPM.LOCALEAST on a relative basis), the Transcon and Local East indexes are up 1.3% and down 6.4%, respectively, versus this time last year.

The Stockout show: Warehouse automation goes mainstream

(Image: FWTV)

On Monday’s The Stockout show, Grace Sharkey and I discussed the freight markets, including the flatbed and less-than-truckload sectors. In addition, we interviewed Brian Kirst, chief commercial officer of SnapFulfil, a warehouse automation company. The show is available on The Stockout YouTube channel.

To subscribe to The Stockout, FreightWaves’ CPG and retail newsletter, click here.

The post Shippers opt for lower-cost, slower services appeared first on FreightWaves.