The American automotive industry finds itself at a critical juncture in 2025, with conflicting signals about its future trajectory. On one hand, recent announcements of major investments and the looming threat of tariffs point to potential growth. On the other, the industry continues to grapple with ongoing challenges that have led to job losses and production cuts in recent years. As automakers and policymakers navigate this complex landscape, the question remains: Is the U.S. auto sector poised for a resurgence?

This is JP Hampstead, co-host of the Bring It Home podcast with Craig Fuller. Welcome to the 19th edition of our newsletter, where we go under the hood of the U.S. automotive industry.

Monday’s news was staggering: South Korean automaker Hyundai announced plans for a $21 billion investment in its U.S. operations. This long-term, strategic commitment includes $9 billion by 2028 to boost production capacity to 1.2 million vehicles annually, potentially creating 14,000 new full-time jobs. Additionally, Hyundai plans to invest $6 billion in strategic partnerships with American companies focused on cutting-edge technologies like autonomous driving, robotics and AI. Perhaps most notably, the company will build a $5.8 billion steel plant in Louisiana, expected to produce over 2.7 million metric tons of steel per year and employ 1,400 workers.

Hyundai’s massive investment comes against the backdrop of potential new tariffs threatened by the Trump administration. The former president, having retaken office, has signaled his intent to impose reciprocal tariffs on numerous countries starting April 2, with South Korea – which maintains a large trade surplus with the U.S. – likely in the crosshairs. President Donald Trump has framed Hyundai’s announcement as validation of his aggressive trade policies, stating, “This investment is a clear demonstration that tariffs very strongly work.”

An assembly line at the Mercedes-Benz plant in Tuscaloose County, Alabama (Creative Commons)

Indeed, the specter of new automotive tariffs looms large over the industry (although Mexico’s and Canada’s automotive trade with the U.S. is protected from tariffs under the United States-Mexico-Canada Agreement). Trump has already reimposed global tariffs of 25% on steel and aluminum imports, extending duties to hundreds of downstream products. Carmakers have lobbied intensely against further tariffs on imported vehicles and parts, with General Motors CEO Mary Barra recently meeting Trump to voice concerns about tariff uncertainty even as she outlined GM’s own plans for $60 billion in U.S. investments.

The flurry of investment announcements in the wake of Trump’s return to office paints a seemingly rosy picture for domestic auto manufacturing. However, industry analysts caution that many of these statements include previously planned expenditures now being repackaged for political expediency. Moreover, the fundamental challenges that have led to recent job losses and plant closures persist.

Chief among these is the ongoing transition to electric vehicles, which requires fewer workers to produce and has disrupted traditional supply chains. While EV sales continue to grow, the pace has been slower than many automakers anticipated, leading to production cuts and delayed launches for some models. The “shift and pause” strategy adopted by several manufacturers highlights the difficulty in balancing innovation with market readiness.

Another significant headwind is the overall state of auto demand. After years of robust sales fueled by low interest rates and pent-up demand following the pandemic, the market has cooled considerably. Higher vehicle prices, elevated interest rates and general economic uncertainty have made consumers more hesitant to make big-ticket purchases. This has led to stubbornly high inventory levels at many dealerships, forcing automakers to offer increased incentives and discounts to move metal off the lots.

The industry also continues to grapple with supply chain disruptions, though these have eased somewhat from their pandemic-era peaks. Shortages of critical components like semiconductors have largely abated, but the push for reshoring and “friend-shoring” of key supplies adds complexity and potential costs to manufacturing operations. Bosch’s announcement of a $1.9 billion investment in semiconductor production in California serves as an example of how the automotive supply chain is reshoring.

Labor issues present another challenge, with recent strikes at several automakers highlighting worker demands for job security and fair compensation in the face of industry transformation. The push to organize new EV and battery plants has also created tension between manufacturers and unions.

So, is the U.S. automotive industry truly poised for a renaissance of jobs and production? The answer, as is often the case in this complex sector, is nuanced. While headline-grabbing investment announcements and the threat of protectionist policies may drive some growth in domestic manufacturing, the underlying structural shifts in the industry are likely to continue reshaping employment and production patterns.

Ultimately, the future of U.S. auto manufacturing will depend on a delicate balance of factors: consumer demand, technological innovation, trade policies and global competitive pressures. As the industry navigates these choppy waters, agility and adaptability will be crucial. Companies and regions that can effectively retool for the automotive future – embracing new technologies and production methods while leveraging existing strengths – will be best positioned to thrive in the years ahead.

Quotable

“Money is pouring in and we want to keep it that way.”

– President Trump, on the $21 billion Hyundai investment announcement on Monday

Infographic

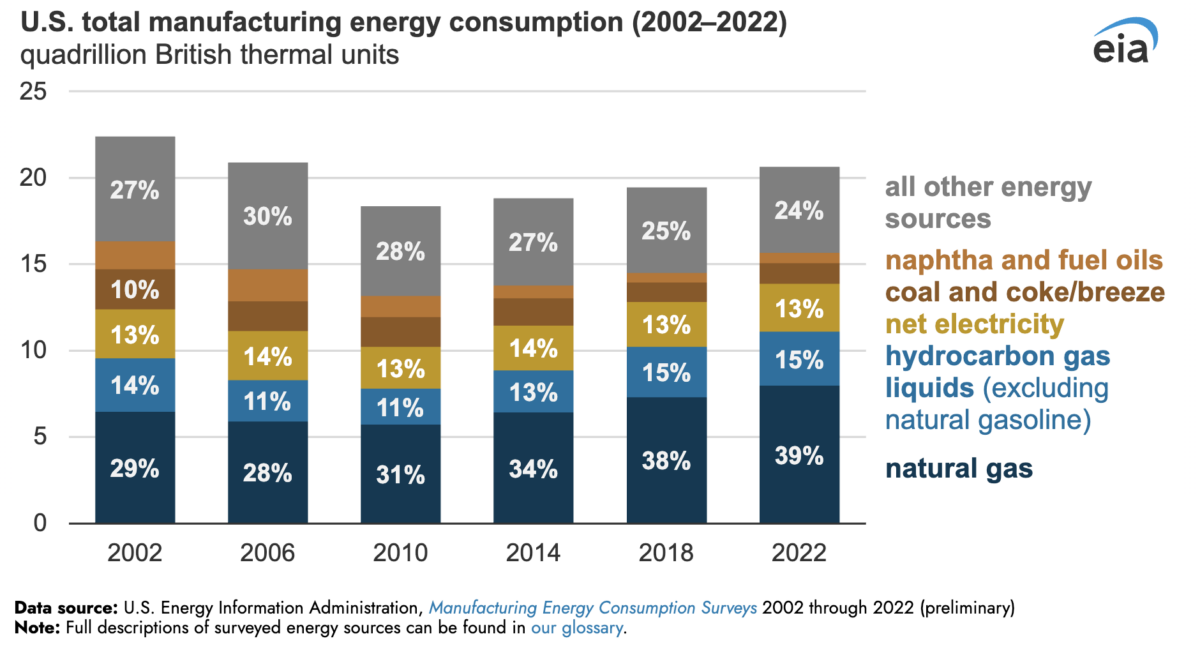

The Energy Information Administration’s (EIA) quadrennial survey data, released Tuesday morning, showed that manufacturing energy consumption has continued to grow (as of 2022), up from its low in 2010.

News from around the web

Hyundai announces a $20 billion investment in the United States

South Korea-based Hyundai and President Donald Trump announced a $20 billion investment in U.S. on-shoring, which includes a $5 billion steel plant in Louisiana, at the White House Monday.

The $5.8 billion Louisiana facility will be the car manufacturer’s first steel manufacturing facility in the U.S. and will produce more than 2.7 million metric tons of steel a year and create more than 1,400 jobs. It will supply steel to auto plants in Alabama and Georgia, Trump said in remarks at the White House.

U.S. manufacturing energy consumption has continued to increase since 2010 low

U.S. manufacturing energy consumption has continued to increase, according to recently released survey results for 2022. The EIA conducts the Manufacturing Energy Consumption Surveys (MECS) every four years, and the latest iteration shows the third consecutive increase in energy consumed in the manufacturing sector since a low point in 2010. Natural gas consumption in the manufacturing sector increased by more than all other energy sources combined, as compared with the previous MECS results from 2018.

German growth edges up in March as manufacturing production rises, PMI shows

Business activity in Germany’s private sector rose at the quickest rate for 10 months in March, amid a first increase in manufacturing production in almost two years, according to a survey published on Monday.

The HCOB German flash composite Purchasing Managers’ Index, compiled by S&P Global, rose to 50.9 in March from 50.4 in February, its highest since May 2024 and above the 50.0 threshold that separates growth from contraction.

Most recent episode

The post Automotive resurgence? Hyundai’s $21B bet on the US appeared first on FreightWaves.