US freight market continued to face headwinds in Q4 2024

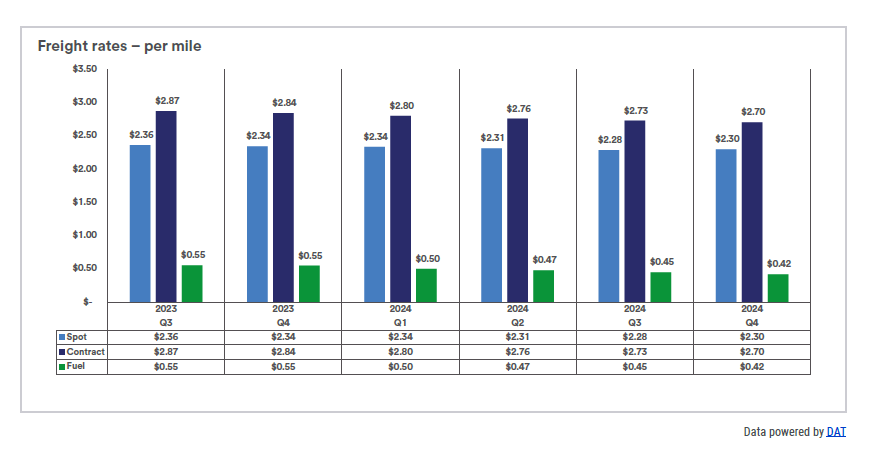

Data released Tuesday by freight audit and payment provider U.S. Bank showed a trucking industry continuing to battle a variety of headwinds. According to the latest U.S. Bank Freight Payment Index, shipment volumes fell 4.7% from the previous quarter, marking the 10th consecutive quarterly decline. Spending by shippers also decreased, albeit at a slower rate of 2.2%.

“It’s clear there are both cyclical and structural challenges remaining as we look for a truck freight market reboot,” said Bob Costello, senior vice president and chief economist at the American Trucking Associations. “For instance, factory output softness – which has a disproportionate impact on truck freight volumes – is currently weighing heavily on our industry.”

Looking at cyclical impacts, the persistent softness in the manufacturing sector played a large role in the freight market’s continued softness. Total factory output declined between 0.3% and 0.6% from the third quarter and 0.5% to 0.9% year over year. Even such modest decreases have a disproportionate impact on truck freight volumes.

Despite the overall market contraction, there are signs of potential stabilization. The fourth quarter’s 15.7% year-over-year decline in shipments was the smallest such decrease in 2024. Additionally, the interplay between shipment volumes and spending suggests a possible tightening of capacity, as spending fell less sharply than shipments despite lower fuel surcharges.

Spot market rates, excluding fuel, rose 0.5% from the third quarter — the first sequential gain since Q1 2022. Year over year, spot rates were down just 1.9%, the best performance of 2024.

January LMI data saw its fastest growth rate since mid-2022

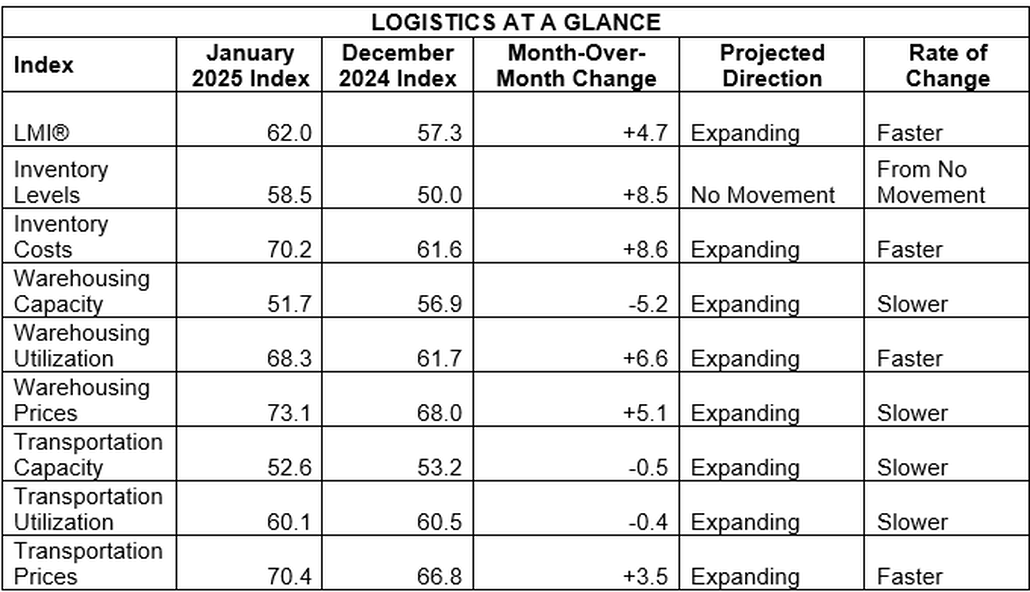

Supply chain activity accelerated in January, with the Logistics Managers’ Index (LMI) registering its fastest growth rate since mid-2022 amid rising inventory levels and transportation prices. The LMI rose to 62 in January, up 4.7 points from December’s reading of 57.3. The LMI is a sentiment index with a reading above 50 indicating expansion in the logistics industry, while below 50 signals contraction.

“This is the fastest reading of expansion in the overall index since June of 2022,” the report noted. “Movements in eight of the seven sub-metrics of this index contributed to this increasing velocity of positive change.”

Inventory levels jumped 8.5 points to 58.5, rebounding from December’s neutral 50 reading. Downstream retail respondents reported a significant jump from 33.9 in December to 56.1 in January.

Transportation prices increased 3.5 points to 70.4, the first time above the 70 threshold since April 2022. “The first time above 70.0 for prices suggests that we may now see the freight market move into a stronger position for carriers,” according to the report.

The report suggests the surge in activity may be driven by firms rushing to build inventories ahead of potential new tariffs. “Given the higher volumes seen at the ports and on intermodal lines it is not surprising that activity increased significantly in the second half of the month,” the authors wrote.

Looking ahead, respondents predict continued expansion over the next 12 months, with the overall LMI forecast at 66.1. However, uncertainty around trade policy presents a potential headwind, as some firms reported “considering stopping orders for a short time in hopes that the tariffs will quickly pass.”

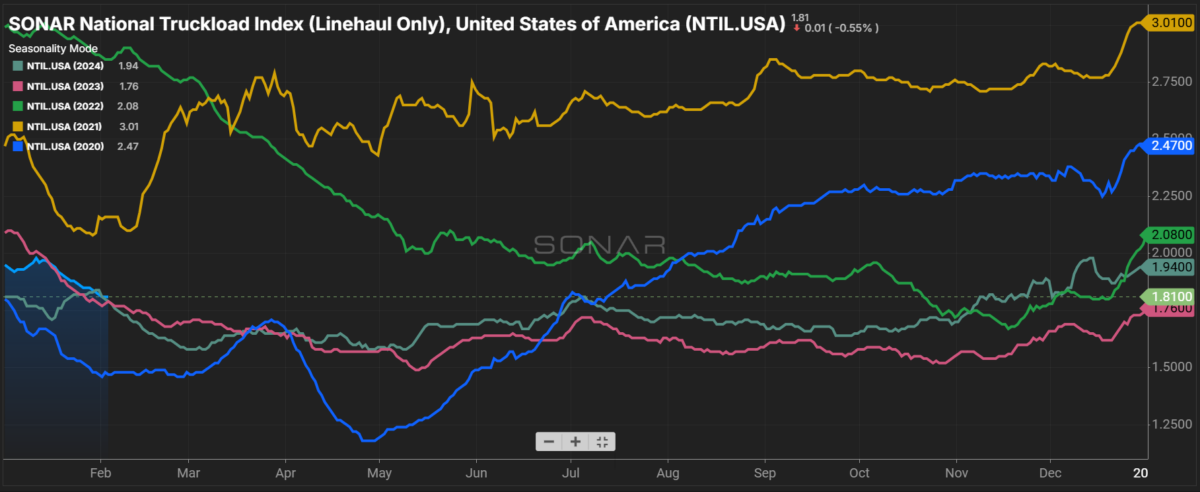

SONAR spotlight: Dry van capacity continues to loosen amid seasonal decline

Summary: The dry van truckload space continues to loosen as spot market linehaul and outbound tender rejection rates grapple with winter seasonality, which historically sees declines extending past Q1 before thawing in spring.

The past week saw the SONAR National Truckload Index (Linehaul Only) fall 4 cents per mile from $1.85 on Jan. 27 to $1.81. The NTIL is now 5%, or 11 cents, lower m/m per mile from $1.92 on Jan. 4. Despite the rapid gains in Q4, the first week of February has spot linehaul rates only 3 cents per mile higher than this time last year.

On the contract side, dry van outbound tender rejection rates fell 61 basis points w/w from 6.53% on Jan. 27 to 5.92%. Despite the declines, VOTRI is 84 bps higher than last year’s value of 5.08%. A positive note is that while VOTRI is higher, dry van outbound tender volumes are lower compared to y/y comps. The impacts of truckload capacity leaving the market show that while VOTRI is 84 bps higher, VOTVI is 173.91, or 2.2%, lower at 7,736.04 points compared to 7,909.95 points on Feb. 4, 2024.

The Routing Guide: Links from around the web

New survey focuses on truck parking at public rest areas (Land Line)

Trucking-backed suit may be arena for dumping Biden independent contractor rule (FreightWaves)

Knight-Swift, J.B. Hunt, Covenant adapt to rising costs challenge (Commercial Carrier Journal)

ATRI’s 3 surveys seek information about diesel technician shortage (Truckers News)

R+L Carriers faces subpoena under Pregnant Workers Fairness Act (Trucking Dive)

Georgia-based RSTZ, with operations also in New England, files for bankruptcy protection (FreightWaves)

Most recent episode

The post Q4 freight market continues to face headwinds appeared first on FreightWaves.