President Donald Trump has once again thrust trade policy into the spotlight, threatening to impose sweeping 25% tariffs on goods from Mexico and Canada. This bold move comes as a shock to many, given the recent ratification of the United States-Mexico-Canada Agreement, which was meant to usher in a new era of North American economic cooperation.

These tariffs were originally scheduled to be implemented on Feb. 1 but were delayed by a month after concessions on border troops by first Mexico, then Canada.

“I just spoke with President Claudia Sheinbaum of Mexico. It was a very friendly conversation wherein she agreed to immediately supply 10,000 Mexican Soldiers on the Border separating Mexico and the United States,” Trump wrote on Truth Social earlier Monday.

The proposed tariffs would apply to virtually all imports from Mexico and Canada, with the exception of Canadian energy imports, which would face a 10% levy. This broad approach marks a significant escalation from Trump’s previous targeted tariffs during his first term. The president has framed these measures as a response to what he perceives as inadequate efforts by Mexico and Canada to stem the flow of illegal immigrants and drugs into the United States.

Trump’s tariff threat comes at a time when North American economic integration is at an all-time high.

The USMCA, which replaced the North American Free Trade Agreement in 2020, was designed to further strengthen economic ties among the three nations. The agreement includes provisions to boost regional content requirements for automobiles, enhance labor protections and modernize intellectual property rules. Now, barely four years into its implementation, the USMCA’s future seems uncertain.

The president is wielding trade policy as a cudgel to address nontrade issues, particularly border security and drug trafficking. By threatening Mexico’s and Canada’s economic interests, Trump hopes to compel them to take more aggressive action on these fronts. For Mexico, this means deploying additional troops to its northern border and intensifying efforts to intercept migrants and drug shipments. Canada, which shares a much longer and more porous border with the U.S., is being pressed to enhance its own border security measures and crack down on the trafficking of synthetic opioids like fentanyl.

This approach represents a significant departure from traditional trade policy, which typically focuses on economic issues such as market access and fair competition. By using tariffs as leverage on security matters, Trump is blurring the lines between trade and foreign policy in a way that has alarmed many economists and diplomats.

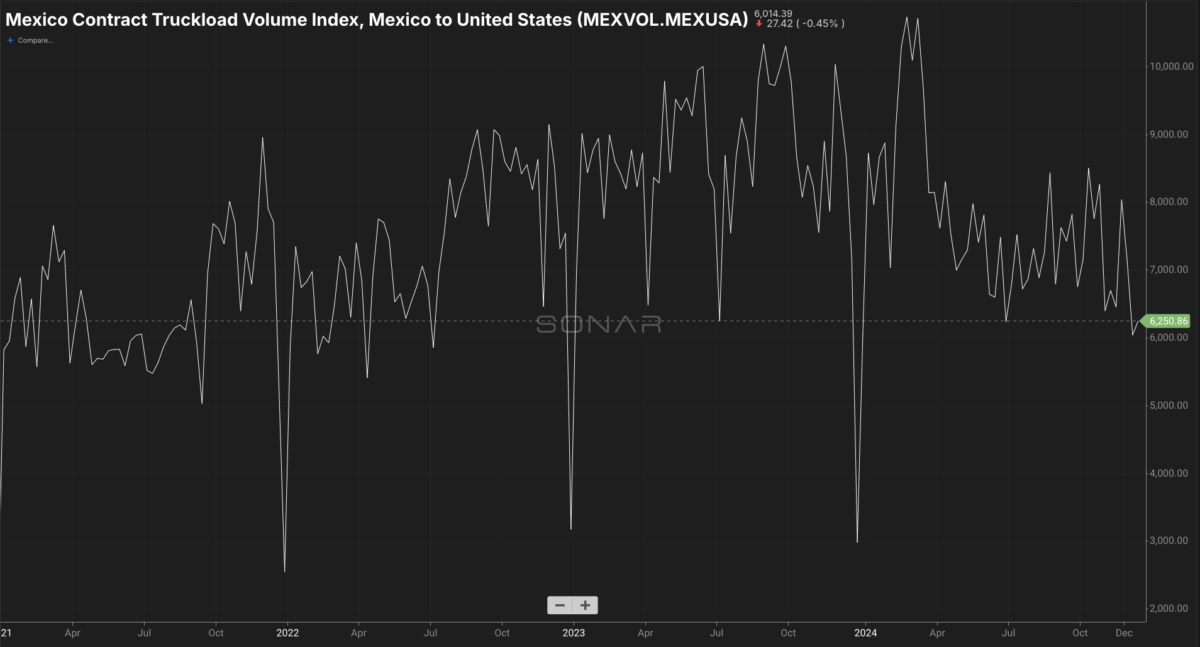

(MEXVOL.MEXUSA is an index of total truckload volume originating in Mexico and bound for the U.S. Chart: SONAR. To learn more about SONAR, click here)

The potential impact of 25% tariffs on Mexican and Canadian goods would be profound and far-reaching. The automotive industry, which has developed intricate supply chains spanning all three countries under NAFTA and the USMCA, stretching from Ontario, Canada, through the Midwest and Southeast and down into the central Bajío region of Mexico, would be particularly hard-hit. Cars and car parts often cross borders multiple times during production, meaning that a 25% tariff could compound into much higher costs for finished vehicles. This could lead to significant price increases for consumers and potential job losses in all three countries as automakers struggle to adapt.

Other industries that would face major disruptions include home appliances, furniture, electronics and food. Many American companies rely on Mexican and Canadian inputs for their products, and a 25% increase in costs would force them to either absorb lower profits or pass the costs on to consumers, likely resulting in higher prices across a wide range of goods.

The food industry could see particularly dramatic effects. Mexico is a major supplier of fresh fruits and vegetables to the U.S. market, especially during winter. A 25% tariff on these products could lead to significant price increases at grocery stores and restaurants. Similarly, Canadian dairy, meat and grain products could become much more expensive for American consumers.

Despite the potentially severe consequences, we believe that these tariffs are unlikely to remain in force for long, if they are ever activated at all. There are several reasons for our skeptical take toward these tariffs in particular.

The sheer scale of economic harm the tariffs would inflict on all three countries makes their removal a pressing concern. American businesses and consumers would bear much of the cost, potentially eroding Trump’s own political support. The widespread economic pressure generated by these tariffs is likely to lead to calls for their swift retraction.

Using tariffs for nontrade objectives could invite both domestic and international legal challenges. The president’s authority to impose such expansive tariffs on the grounds of national security might be scrutinized in U.S. courts, raising questions about the validity and sustainability of the measures.

In the unlikely event the tariffs are implemented, they would almost certainly provoke retaliatory actions from Mexico and Canada. Those countermeasures could intensify the economic pain and potentially ignite a broader trade war, further complicating North American trade relations.

But Trump’s history of employing extreme threats as a negotiating tactic suggests that this might be another manifestation of his “art of the deal” approach to international diplomacy. He has often scaled back or accepted more modest concessions, indicating that the tariffs might simply be a strategic move to gain leverage.

Indeed, it’s our view that Trump’s tariff threats against Mexico and Canada are meant to help the White House pick up early wins on border security and the fentanyl crisis, which has become one of the leading causes of death for American adults.

Within Trump’s own party, there is likely to be substantial opposition to these sweeping tariffs, particularly from states with significant agricultural interests and ties to the automotive industry. Political backlash from those sectors could further undermine support for the tariffs, making their prolonged enforcement doubtful.

While Trump’s tariff threats have sent shockwaves — or at least spread confusion and uncertainty — through the North American business community, the extreme nature of the proposed measures makes their long-term implementation unlikely. Instead, this move is likely intended as a dramatic opening bid in negotiations over border security and drug trafficking: national sovereignty more broadly conceived.

China and Europe are different matters entirely, though, and Trump may be working with a different decision calculus.

The post Making sense of Trump’s new trade war appeared first on FreightWaves.