Latin America is undergoing a significant transformation in the maritime shipping industry, with several countries vying to become leading port hubs in the region. As global trade continues to shift and evolve, the ability of a country to strengthen its shipping and port connectivity becomes a critical factor in its economic success.

This article delves into the key indicators—Shipping Connectivity and Port Connectivity Indexes—exploring how different Latin American countries are responding to the growing demands of maritime trade and positioning themselves for long-term success.

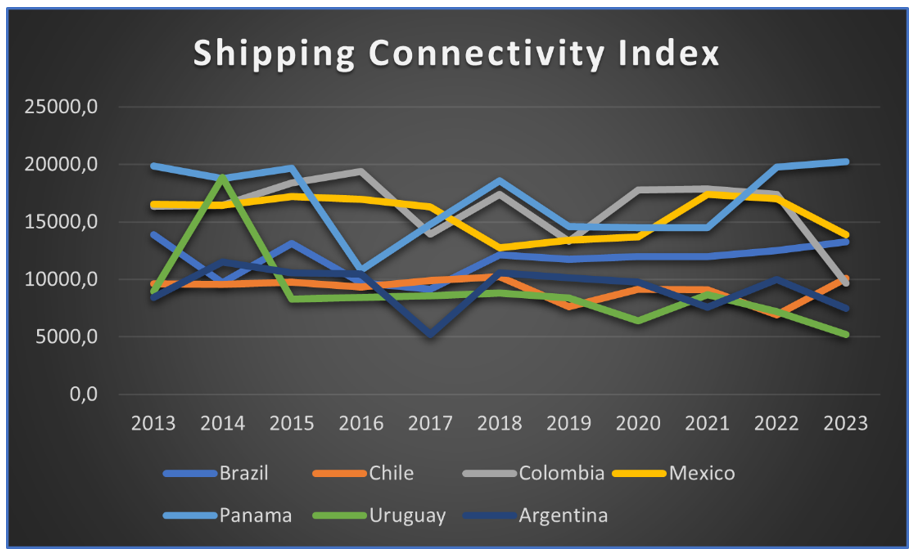

Panama stands as the leader in shipping connectivity, leveraging its strategic position and the Panama Canal to dominate the region. However, it has not been without challenges. Panama faced two major declines in its shipping connectivity, the first in 2015, from which it rebounded successfully. A second, more prolonged decline occurred between 2018 and 2021, during which Panama saw a sharp drop in its index. Despite these setbacks, Panama managed to reverse the trend, stabilizing and increasing its connectivity index by 2023, reaffirming its position as a vital maritime hub.

Since 2018, Brazil’s shipping connectivity index has maintained a steady pace, albeit lower than Panama, Mexico, and Colombia. However, it began to improve significantly, allowing Brazil to surpass Colombia, which experienced a sharp decline starting in 2022. Mexico, despite a slight increase in shipping connectivity in 2020, also saw a decline after 2022. Brazil is now aiming to catch up with Mexico in terms of shipping connectivity.

Chile, similarly, appears to be focusing on developing its shipping connectivity. Due to Colombia’s significant decline, Chile has managed to surpass in this area. Uruguay, on the other hand, experienced a spike in connectivity back in 2014, facing a sharp and steady decline since then, leaving it far behind other regional players. A new decline in Uruguay’s connectivity began in 2021, further reducing its competitiveness.

Colombia experienced fluctuations in performance, showing signs of decline after 2020, and has struggled to maintain its position since, though this is not seeming easy after a really sharp decline in that indicator’s performance.

When considering shipping connectivity, Brazil and Chile emerge proactive players in Latin America, both showing clear signs of striving to improve this critical indicator.

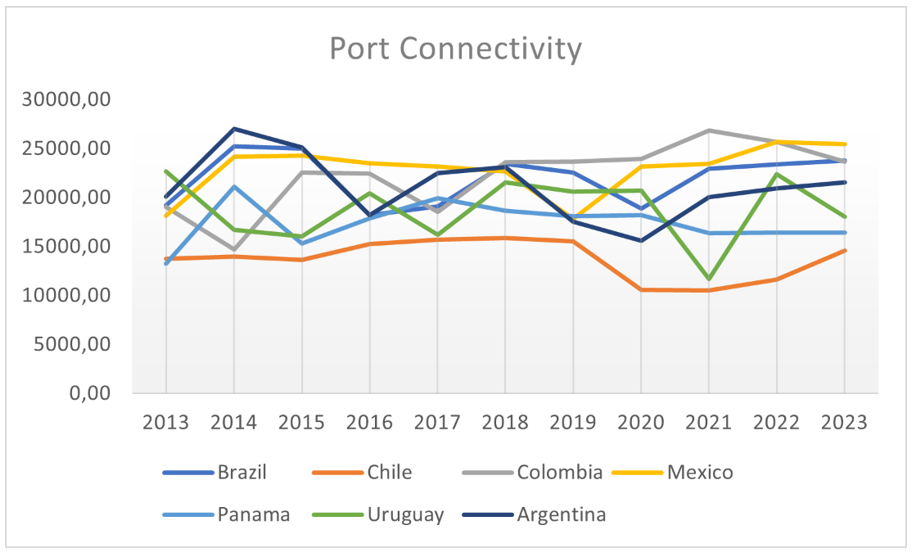

When examining the Port Connectivity Index, it becomes evident that there is growing competition among Latin American countries, driven by an escalating race for port infrastructure investments. This “race for investments” reflects the strategic importance of ports in maintaining and enhancing global trade links.

Mexico presents an interesting case. While its shipping connectivity has declined, its growing port infrastructure suggests potential for recovery. If Mexico can align its port improvements with broader shipping strategies, it could regain its competitive edge. Since 2021, it has managed to surpass Colombia in port connectivity, matched it in 2022, and overtook it again in 2023. This steady improvement positions Mexico as a strong contender in the region’s port infrastructure landscape.

Although Chile ranks lower on the connectivity table, it has begun to gain momentum in 2023, following a period of relative stability. This newfound momentum suggests that Chile could further strengthen its position in the coming years.

Brazil also shows a promising trend in port connectivity. With continued growth, it is expected to surpass Colombia soon and possibly reach Mexico’s levels in the near future, positioning itself as one of the leading players in Latin America’s port infrastructure race.

In contrast, Uruguay faces significant fluctuations, with a declining trend overall. Similarly, Argentina has experienced ups and downs but appears to be gaining momentum, and it could potentially compete with Mexico in the coming years if this trend continues.

Interestingly, Panama, despite its dominant shipping connectivity, shows a surprisingly low index for port connectivity. This disparity highlights a striking contrast between its strong maritime routes and the relative underperformance of its port infrastructure, which may require further investment to align with its shipping strength. Despite its historical dominance in shipping, the country faces a unique challenge. Its low port connectivity is a clear area for improvement, and without investment in this sector, Panama may struggle to fully capitalize on its geographic advantage and maintain its lead.

Countries like Colombia and Uruguay are more concerning. Colombia, once a strong player, seems to be on a downward trend, and without intervention, it risks falling further behind. Uruguay, with its inconsistent performance, also faces challenges in maintaining relevance.

In conclusion, the region’s future hinges on continued investments in port and shipping infrastructure. Brazil, Chile, and Mexico are positioned to thrive if they maintain this focus, while Panama’s long-term success depends on its ability to boost port connectivity.

Alexandros Itimoudis

Shipping Analyst